How to Use My Credit Report Number to See My Report Again

Why is my credit written report important?

Businesses look at your credit report when you apply for:

- loans from a bank

- credit cards

- jobs

- insurance

If you apply for one of these, the business concern wants to know if y'all pay your bills. The business also wants to know if you owe money to someone else. The business concern uses the information in your credit study to decide whether to give yous a loan, a credit carte, a job, or insurance.

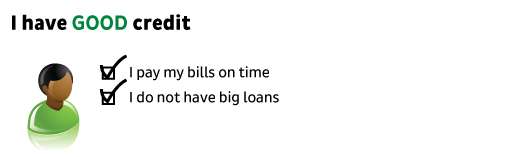

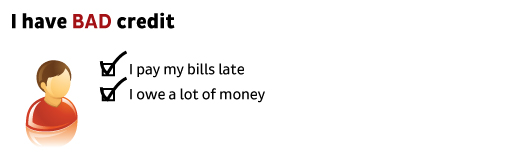

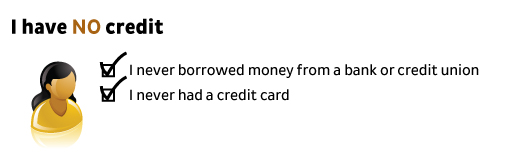

What does "skilful credit" mean?

Some people have skillful credit. Some people have bad credit. Some people do not take a credit history. Businesses see this in your credit report. Unlike things happen based on your credit history:

That means:

- I have more loan choices.

- It is easier to get credit cards.

- I pay lower interest rates.

- I pay less for loans and credit cards.

That means:

- I have fewer loan choices.

- Information technology is harder to get credit cards.

- I pay higher interest rates.

- I pay more for loans and credit cards.

That ways:

- I have no bank loan choices.

- Information technology is very hard to get credit cards.

- I pay high involvement rates.

- Loans and credit cards are hard to become and cost a lot.

All this data is in your credit study.

Why should I go my credit report?

An important reason to get your credit study is to find bug or mistakes and fix them:

- Y'all might observe somebody's data in your written report past fault.

- Y'all might detect information about you from a long time ago.

- You lot might find accounts that are non yours. That might mean someone stole your identity.

You want to know what is in your study. The information in your study will assistance make up one's mind whether you get a loan, a credit carte, a job or insurance.

If the information is wrong, yous can try to prepare it. If the data is correct – only not so good – you can try to improve your credit history.

Where do I get my gratuitous credit study?

Yous tin get your free credit report from Almanac Credit Report. That is the merely free place to get your study. You tin can get it online: AnnualCreditReport.com, or by phone: i-877-322-8228.

You lot go one complimentary report from each credit reporting company every year. That means you become iii reports each year.

What should I do when I get my credit report?

Your credit study has a lot of information. Bank check to see if the data is correct. Is information technology your name and address? Do y'all recognize the accounts listed?

If at that place is incorrect information in your report, try to fix it. You tin can write to the credit reporting company. Ask them to modify the information that is wrong. Y'all might need to transport proof that the information is wrong – for case, a copy of a bill that shows the correct information. The credit reporting company must check it out and write back to you.

How practice I improve my credit?

Await at your free credit report. The report will tell y'all how to improve your credit history. Merely you tin can improve your credit. No ane else can fix information in your credit written report that is not proficient, but is correct.

It takes time to improve your credit history. Here are some ways to assistance rebuild your credit.

- Pay your bills by the date they are due. This is the most important thing yous can do.

- Lower the amount you owe, especially on your credit cards. Attributable a lot of money hurts your credit history.

- Exercise non get new credit cards if yous exercise non need them. A lot of new credit hurts your credit history.

- Practice non close older credit cards. Having credit for a longer time helps your rating.

Later on vi to nine months of this, cheque your credit report once more. Y'all tin can employ one of your gratis reports from Annual Credit Study.

How does a credit score work?

Your credit score is a number related to your credit history. If your credit score is high, your credit is expert. If your credit score is low, your credit is bad.

There are different credit scores. Each credit reporting company creates a credit score. Other companies create scores, too. The range is unlike, only it usually goes from about 300 (low) to 850 (high).

It costs money to look at your credit score. Sometimes a company might say the score is costless. But commonly at that place is a toll.

What goes into a credit score?

Each company has its own manner to calculate your credit score. They expect at:

- how many loans and credit cards you accept

- how much money yous owe

- how long you take had credit

- how much new credit yous have

They look at the data in your credit report and give it a number. That is your credit score.

It is very important to know what is in your credit written report. If your report is practiced, your score will be good. Y'all can decide if it is worth paying money to encounter what number someone gives your credit history.

Read more

Source: https://consumer.gov/credit-loans-debt/your-credit-history

0 Response to "How to Use My Credit Report Number to See My Report Again"

Post a Comment